Many superannuation funds perform well when share markets are strong, but not so well when they’re down.

In that context, the GFC was a game-changer for QSuper.

Members told us protecting the value of their superannuation accounts from the worst effects of share market downturns was especially important to them. At the same time, they wanted to be able to participate in rising share markets.

So post-GFC, QSuper devoted a lot of research into trying to develop investment strategies to achieve this. Our response, which we began rolling out from 2011, was to invest in a “risk-balanced” way.

As the term implies, QSuper’s strategy focusses on achieving a reasonably even spread of risks in our Balanced option.

This was a break from existing industry practice, which was based on diversification across asset classes (the amount of money spread over different investments).

A conventional balanced super fund may look balanced when looking at the amount of money spread across different types of investments, but, is dominated by equity risk[2] — the risk associated with share market investing.

That may be great when share markets are strong, but not so good when they struggle. The allocation to non-share market exposure risk in a typical balanced fund is just too small to counter share market/equity risk.

“Risk balanced” investing was our response to this problem that dogs many superannuation funds. The QSuper way potentially results in a more even distribution of risks.

What this meant for QSuper’s Balanced option was dialling down equity risk (the risks associated with share market investments) and dialling up risks (and return potential) from other asset classes, led by bonds, as well as direct infrastructure, real estate, private equity (privately owned companies not listed on stock exchanges) and alternative investments like commodities.

The old saying that “the proof of the pudding is in the eating” is relevant to superannuation too. Theoretically good ideas can come unstuck in the real world.

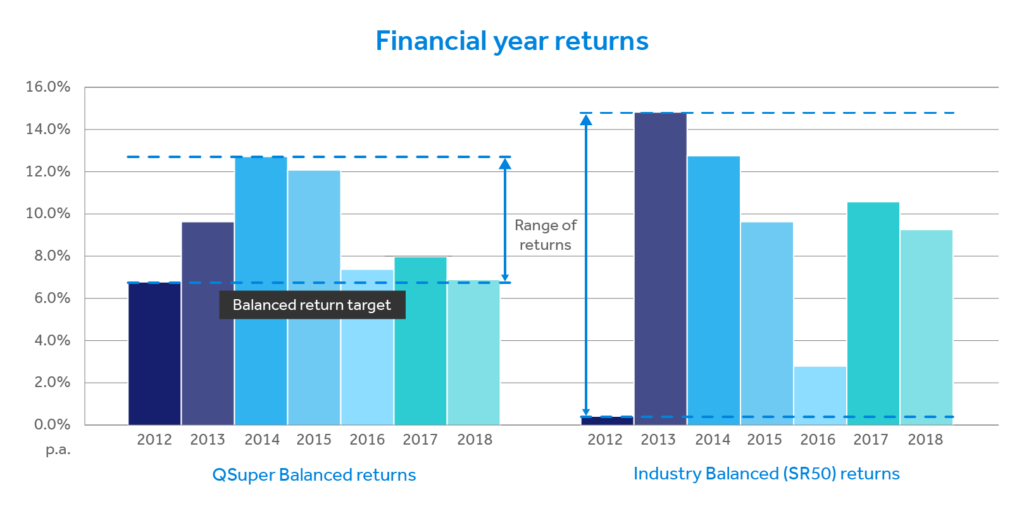

Most recently this has seen QSuper’s Balanced investment option topping the 10-year returns in SuperRatings’ survey[3], and it has done so with more even year-by-year performance (see chart below) compared to the representative superannuation industry balanced fund.

To know more about QSuper and how we invest members’ superannuation please see https://qsuper.qld.gov.au/our-products/why-qsuper or call 1300 360 750.

QSuper Balanced option returns vs. median balanced fund in Chant West Growth Funds category

Source: SuperRatings SR50 (60-76% Growth) Index. Returns data to 30/06/2018

This is general information only, using sources that we believe are reliable and accurate at the time of publication. The QSuper products are issued by the QSuper Board (ABN 32 125 059 006, AFSL 489650) as trustee for QSuper (ABN 60 905 115 063). Consider whether the product is right for you by reading the product disclosure statement (PDS) available from our website or by calling us on 1300 360 750. © QSuper Board 2019

[1] Chant West media release 17 January 2019. Past performance is not a reliable indicator of future performance. This is the return for the option before administration fees and the actual returns received by members would vary depending on contributions, investment options chosen and cash flow timings.

[2] The assessment of equity risk is based on based on QSuper analysis of the Super Ratings SR50 Balanced (60-76) Index median fund asset allocation.

[3] SuperRatings SR50 Balanced Index (60-76) median based on cumulative returns compounded annually after fees and for initial $50,000 invested over the period to 31 December 2018. Past performance is not a reliable indicator of future performance.

Do you have an idea for a story?

Email [email protected]

Education Review The latest in education news

Education Review The latest in education news